This summer, former cryptocurrency king Sam Bankman-Fried saw his bail revoked and dethroned Theranos chief Elizabeth Holmes reported to prison. Both have found themselves at the center of two of the biggest financial scandals in history. Where they’ll ultimately end up in the pantheon of corporate malfeasance is anyone’s guess, but this seems like a good time to look back at the history of executives who robbed their companies and/or investors blind. These are 20 of the most shocking financial crimes ever—including the case that basically pioneered the genre.

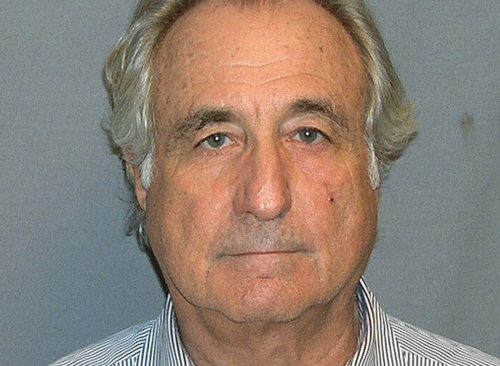

New York wealth manager Bernie Madoff operated the largest Ponzi scheme in history, defrauding 40,000 investors of $64.8 billion. Promising high returns with little risk, he used new investors’ money to pay off earlier investors. Madoff said he started the scheme in the ’90s, but others testified he may actually have begun two decades earlier. It’s considered the biggest financial fraud of all time. In 2009, Madoff was sentenced to 150 years in prison, where he died in 2021.

The Texas-based energy company collapsed in October 2001 after it was revealed the firm’s top executives had been seriously cooking the books. The company manipulated its financial statements, hid debt, inflated profits, and engaged in risky speculative business ventures. Investors and employees lost billions in what was briefly the largest corporate bankruptcy of all time. Read on to find out what claimed that title a year later.

The company’s second-largest long-distance company, WorldCom went bankrupt after it came to light that management had inflated its assets—by about $11 billion. The CEO was sentenced to 25 years in prison, and WorldCom supplanted Enron as the biggest accounting fraud in American history.

The collapse of the 158-year-old investment firm almost took the American economy down with it. The bank had taken excessive risks, investing heavily in subprime mortgages that turned out to be worthless. The company’s abrupt bankruptcy caused a 4.5% drop in the Dow Jones—the biggest daily dip since the 9/11 attacks—and forced the government to step in to prevent a chain reaction in the banking system.

Ever wondered who gave the Ponzi scheme its name? That would be Italian fraudster Charles Ponzi, who invented this category of scam in the 1920s. Ponzi hatched a scheme to buy discounted U.S. postage stamps in one region and sell them at full price elsewhere; he promised investors a 50% profit in 45 days or 100% profit in 90 days. The racket produced nowhere near the profit Ponzi promised, so he paid his early investors with money contributed by newer investors. The house of cards collapsed when too many investors demanded their money back. Ponzi was ultimately sentenced to five years in federal prison and was deported to Italy upon his release.

Even non-customers were shocked by news in 2016 that employees of Wells Fargo had been incentivized to open up fake accounts under real customers’ names, with the goal of boosting the bank’s profits. But that wasn’t all: In December 2022, the bank was ordered to pay $3.7 billion for “illegal activity” involving the mismanagement of 16 million client accounts. According to the Consumer Financial Protection Bureau, Wells Fargo “repeatedly misapplied loan payments, wrongfully foreclosed on homes and illegally repossessed vehicles, incorrectly assessed fees and interest, and charged surprise overdraft fees.”

In 2004, Stanford University dropout Elizabeth Holmes founded a startup that claimed to have pioneered technology that could perform hundreds of medical tests with a single drop of blood. In 2015, medical regulators exposed this as impossible, and Holmes and Theranos co-founder Sunny Balwani were charged with fraud and conspiracy for goose-chasing the company’s valuation to $10 billion. In late 2022, the pair were sentenced to 11 and 12 years in prison, respectively, and ordered to pay restitution of $452 million to investors, including $125 million to Rupert Murdoch.

In November, the cryptocurrency exchange FTX filed for bankruptcy, and its CEO, Sam Bankman-Fried, resigned. Its new CEO—who had handled the aftermath of Enron’s collapse—said he had never seen “such a complete failure of corporate control.” Anywhere from $1 billion to $2 billion of customer money can’t be accounted for. Bankman-Fried’s net worth of $16 billion vaporized to zero, he was sued by several celebrities (including Tom Brady and Larry David), and he’s currently awaiting trial for fraud and other charges.

In the ’80s, 32% of the nation’s savings and loan associations (S&Ls) failed—more than 1,000 banks. Mismanagement and fraud—enabled by the relaxation of regulations designed to prevent imprudent lending and minimize insolvency—mushroomed into a $150 billion calamity.

Nicknamed “Pharma Bro,” hedge fund manager Shkreli drew widespread ire when he acquired rights to obscure drugs and raised their prices substantially. In 2017, he was convicted of securities fraud and sentenced to seven years in prison. A U.S. attorney said: “Shkreli essentially ran his company like a Ponzi scheme where he used each subsequent company to pay off defrauded investors from the prior company.”

Unwise investments in mortgages by AIG’s Financial Products unit brought the entire company to its knees during the financial crisis of 2008, “leading to a cascading series of bank failures that nearly caused a global economic collapse,” the Associated Press reported.

Trader Nick Leeson engaged in unauthorized speculative trading that caused the world’s oldest merchant bank to lose more than $1 billion, forcing it to fold. Leeson was later portrayed by Ewan McGregor in the appropriately titled 1999 movie Rogue Trader.

The infamous trader lined his pockets with $200 million by using inside information to bet on corporate takeovers and company mergers. His exposure led to one of the biggest financial scandals to that point; insider trading had rarely been prosecuted before. Boesky served 3 ½ years in jail, was fined $100 million, and was permanently banned from the securities industry. He reportedly inspired Michael Douglas’s ruthless character Gordon Gekko in the 1987 movie Wall Street.

In the mid-2010s, FIFA, the governing body of international soccer, was rocked by a major corruption scandal involving bribery, kickbacks, and money laundering among high-ranking officials.

The security systems company’s CEO, Dennis Kozlowski, engaged in an eye-popping run of embezzlement and corporate fraud, granting himself $81 million in unauthorized bonuses and loans, including $14 million to buy art, and $20 million in secret fees to a businessman who brokered one of the company’s many acquisitions. Convicted in 2005, Kozlowski served six years in prison.

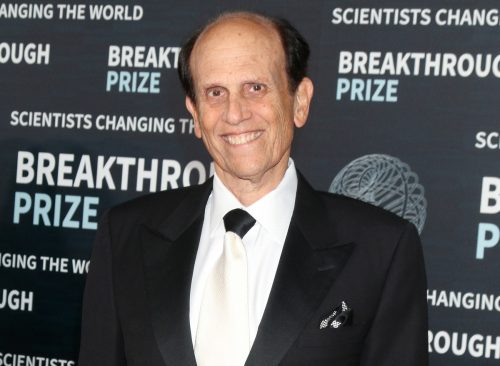

The American investment bank—which boasted 10,000 employees and more than $545 million in income at its peak—was forced into bankruptcy in 1990 because of its illegal activities in the high-yield bond (“junk bond”) market, driven by executive Michael Milken. In 1989, Milken pleaded guilty to securities fraud, was sentenced to 10 years in prison, and fined $600 million. In 2020, he was pardoned by President Donald Trump. Today, Milken is one of the richest men in the world, with a net worth of $6 billion.

The Italian dairy and food corporation engaged in a massive accounting fraud in which executives invested $18 billion in fake assets, creating fraudulent bank accounts with huge and non-existent cash balances.

The Texas-born, Antigua-based financier sold fake certificates of deposit through his Caribbean bank, promising high returns. Ultimately, authorities determined Stanford defrauded investors of $8 billion. In 2012, the 61-year-old was sentenced to 110 years in prison.

The healthcare company overstated its earnings by $2.7 billion between 1996 through 2002, creating a scandal that “left a trail of misery in its wake,” CFO.com reported. Numerous company officials were sent to prison, including CEO Richard Scrushy and several financial executives.

RELATED: 30 Area Codes to Watch for in Latest Phone Scam

The Japanese camera and medical equipment company covered up billions in investment losses for years—up to $4.9 billion in company assets couldn’t be accounted for, dating back to the 1980s. The revelation wiped out 80% of the company’s Japanese stock market valuation, two executives went to prison, and the company was ordered to pay out $594 million to shareholders—the largest such fine in Japan’s history.