In recent years, when to retire—and if it’s even possible—has become one of the most fraught life events, as many younger Americans have begun to reduce or skip saving for retirement to pay for everyday expenses. If you’re working on your retirement plan, you may be surprised to know that, even though you’ll be living on a fixed income, where you retire can make a real difference in how far those dollars stretch. Insider Monkey recently ranked the worst states to retire in, according to tax rates and cost of living. Read on to see the list, which starts with #20 and ends with the #1 worst place to retire.

Cost of living: 100.5% of national average

Rhode Island has a “high overall tax burden,” the financial site says. Its property taxes are 15th highest in the nation, seniors must pay tax on their social security benefits (if their federal adjusted gross income is more than $119,750) and the cost of living is slightly above the national average (0.5%).

Cost of living: 101.5% of national average

“One of the few states that tax social security, Utah may not be the ideal place to retire,” the site says. Another reason: Retirement incomes such as pensions are taxed by the state at 4.85%.

Cost of living: 103.1% of national average

Although sales and property taxes are low in Virginia, income taxes the state’s cost of living are slightly higher than other states. “Retirees can certainly go for better options,” the site’s experts say.

Cost of living: 103.7%

The Treasure State isn’t so eager to help retirees hang on to theirs—most types of retirement income are taxed in Montana. Although property tax rates are reasonable, the cost of living is almost 4% higher than the national average.

Cost of living: 105.5%

Colorado is a mixed bag for retirees, the financial site found. Although retirement incomes are largely tax deductible and property tax rates are low, sales tax can run as high as 11% in some areas of the state.

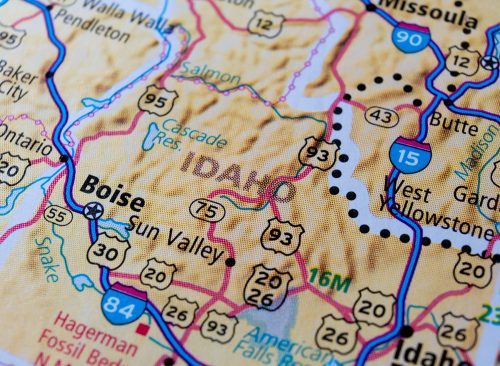

Cost of living: 106.1%

Idaho taxes some types of retirement incomes, and unlike many states, there’s a tax on groceries, contributing to a cost of living that’s 6.1% above the national average.

Cost of living: 107.2%

Arizona applies a “moderate” tax burden to retirees, the financial site found: Although social security benefits aren’t taxed, distributions from 401(k)s and other retirement are. Sales tax hovers around 8%, pushing up the cost of living.

Cost of living: 111.5%

Maine is not the best choice for retirees, considering some forms of retirement income are taxed as high as 7.15%. Sales tax is 5.5%, the property tax rate is “above average” at 1.09%, and the state has an estate tax.

Cost of living: 113.1%

“All types of retirement incomes are taxed under Connecticut’s income tax system,” although some social security benefits may be exempt depending on income, the site explains. Along with a “high” property tax rate (2.15%), the state levies a sales tax of 6.5% (excluding groceries, prescription drugs, and clothing under $50).

Cost of living: 114.1%

The Garden State is named “one of the least friendly states to retire to” in the survey because of its high cost of living (14.1% above the national average), driven by one of the highest property tax rates in the country.

Cost of living: 114.9%

Most retirement income is taxed in the Green Mountain State, at rates that currently range from 3.35% to 8.75%. The median property tax is the fifth-highest in the country.

Cost of living: 115%

Although New Hampshire doesn’t tax salaries and wages, dividends and interests are taxed at 4%—meaning retirees with investment incomes are hit with that bill. But the situation will improve: That tax is being reduced 1% each year until 2027, when it will be phased out entirely.

Cost of living: 115.1%

Even though Oregon has no sales taxes and a lower-than-average property-tax rate, it still ranks in the bottom 10 among states for retirement. That’s because income from retirement accounts like 401(k)s are taxed at the full state rate.

Cost of living: 115.5%

Washington hits the bottom ten because of its high sales taxes, which average 8.86% and push the cost of living 15.5% above what’s typical nationally.

Cost of living: 119.5%

Maryland is another state that offers mixed signals to retirees. Although social security and 401(k) distributions aren’t taxed, other types of retirement income are subject to the full state rate, up to 5.75%. Add in a sales tax of 6%, and you have a cost of living almost one-fifth above the national average.

Cost of living: 125.1%

The state that houses the business capital of the world is not the place to go for tax savings. The income tax rate is “very high,” the site says, noting that New York City taxes are 3% to 4% higher, property tax rates are “steep,” and the sales tax is currently 8.52%.

Cost of living: 134.5%

“Living expenses in the state are 34.5% above the national average, and the state also boasts some of the highest sales taxes in the United States,” the site notes—currently 8.82%. Pensions and retirement accounts are taxed at one of the highest rates in the nation.

Cost of living: 148.4%

Massachusetts is ranked one of the three worst states for retirees because its cost of living is “extremely high”—nearly 50% above the national average.

Cost of living: 148.7%

In D.C., social security benefits are tax exempt but other forms of retirement income are subject. Its sales tax rate of 6% is similar to neighboring Virginia and Maryland. Another commonality: DC’s high cost of living earns it the thumbs-down for retirees.

Cost of living: 179%

If you want to retire to paradise, it won’t come cheap: Hawaii’s cost of living is 79% above the national average. The culprits: retirement savings accounts and pensions are fully taxed, and the sales tax rate is 4.4% (not even groceries are exempt).