According to a report from AARP, a whopping 42 percent of adults in the U.S. have dealt with fraud first-hand. “That’s huge,” says Kathy Stokes, AARP’s director of fraud prevention programs. “Ten years ago, the presumptions were that maybe about 15 percent of people had experienced fraud.” Scammers are becoming increasingly sophisticated and ruthless in the tactics they use to part seniors from their assets—here are 15 common scams to be aware of.

1

Imposter Scams

Scammers can use information about you to make it look like they are calling from your bank or a trusted government agency. They can use this information to take over bank accounts or sell your information to other scammers. “This is the most common form of fraud reported to the Federal Trade Commission (FTC), which logged nearly 985,000 complaints about impostor scams in 2021,” says AARP. “Those cons collectively cost victims more than $2.3 billion, nearly double the 2020 total, according to FTC data.”

2

Phishing Scams

Phishing scams are a common method of fraud. “Similar to impostor scams, in phishing, scammers create emails, online advertising, and even whole websites to pretend to be someone else, earn your trust, and get valuable personal information or access to your money,” according to the Ohio Department of Aging.

3

Telemarketing Scams

Never give your private information to unsolicited callers. “While some telemarketers call to sell you something, other robocallers want to steal your money or your personal information,” warns NCDOJ. “Robocallers cost people as much as $40 billion a year.”

4

Investment Scams

If something sounds too good to be true, it probably is. Be careful about scammers calling up about investment opportunities and asking for payment over the phone. Never buy or invest in something that doesn’t make sense.

5

Healthcare Scams

Scammers may convince you to buy cheap prescription medication or miracle cures. Never buy medication from a telemarketer unless you can verify where it’s coming from. It’s not worth the health or financial risk.

6

Grandparent Scam

Scammers may pretend to be a friend or family member in danger, even using AI to fake their voice. “Criminals will sometimes pretend to be a family member or a grandchild in trouble and in need of money,” says NCDOJ. “They find out who your loved ones and grandchildren are by scouring the internet and social media, so that when they call you, they have enough information to make the call sound real.”

7

IRS/Social Security Scams

Scammers will pretend to be calling from the IRS to con you out of money through fear and coercion. “People who respond to the call are asked to pay immediately,” says the Ohio Department of Aging. “They may also be asked to use an unusual payment type, like purchasing a gift card and reading the card numbers over the phone.”

8

Funeral Scams

Scammers will see the funeral notice and call the relatives, making up claims to get money. They might say the deceased left behind debt that needs to be paid. They may also pretend to be from the funeral home and say there are outstanding fees that still need to be paid.

9

Charity Scams

Be careful who you donate money to online. Scammers use social media like Facebook to set up fake accounts. If you see a charity drive or money being raised to help someone, verify it’s legitimate and the people are real.

10

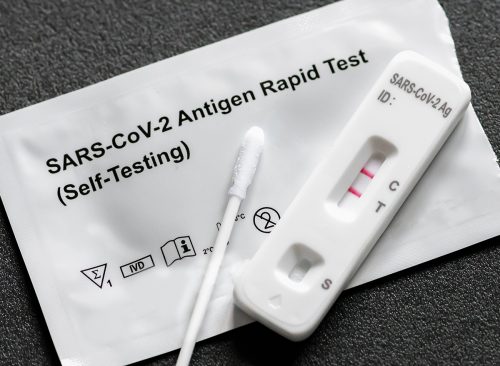

COVID-19 Scams

Scammers are using the pandemic to con seniors out of their money and personal information. “Somebody calls unsolicited, offering to send a COVID test,” Tiffany Erhard, New York state Senior Medicare Patrol director, tells AARP. “They aren’t sending real tests, but they’re billing as if they are, and they’re taking the person’s information to use it unscrupulously or sell it.”

11

Tech Support Scams

Scammers will call and say there is something wrong with your computer and ask for access to the device. They may then demand payment or personal information to fix the issue, or even take control of your devices.

12

Lottery Scams

Scammers will call and say you have won sweepstakes or a lottery you don’t even remember taking part in, requesting “processing” funds to send you your winnings. “This scam generally begins with a call or letter claiming you have won millions of dollars in a lottery or sweepstakes,” says the Ohio Department of Aging. “Odds are, you won’t remember entering this contest, because you most likely didn’t.”

13

Reverse Mortgage Scam

Scammers may call and offer access to equity in your home through a reverse mortgage. Don’t give any information away over the phone, or share documents. Only work with a licensed professional if that’s something you would be interested in.

14

Caregiver Scams

Be careful about leaving personal information lying around. Caregivers, or anyone who is frequently in your home, could steal your personal information and use it for fraud purposes.

15

Sweetheart Scams

Scammers will build a fake relationship—friendly or romantic—with the long-term aim of getting money from you. “These scammers are committed to their con, not you,” says the Ohio Department of Aging. “They are dedicated and willing to commit a lot of time and effort to their crime. They get to know you, which makes them very dangerous. They earn your trust specifically so they can betray it.”