The 9 Best States to Win the Lottery In

Some states are significantly more windfall-friendly than others.

As the MegaMillions jackpot climbs past $900 million, one of the periodic strains of lottery fever has become a national epidemic. If you’ve ever fantasized about winning big, you’ve likely surmised that the amount of jackpot you’d be able to take home depends on your state of residence (and its policy on taxing lottery winnings). Some states are significantly more windfall-friendly than others. These are the nine best states to win the lottery in—and some important things to consider if you happen to get so lucky.

1

What’s the Federal Tax Rate?

Even if you live in a state that doesn’t automatically take a cut of your winnings, the federal government requires you to hand over its share. If you win more than $5,000 from any lottery game (including Powerball and MegaMillions), they are required to withhold 24% in federal taxes before you get your payout.

2

You’ll Need Help

Regardless of where you live, experts recommend assembling a team to help you manage your winnings before you collect the prize. That should include an attorney, a tax advisor, and a financial advisor, advises Robert Pagliarini, author of The Sudden Wealth Solution.

3

Should You Take a Lump Sum Payout?

Any big lottery win comes with a major decision: Do you take the lump sum payout all at once or go for an annuity, where you’ll receive a certain amount each year? Experts say the right answer depends on your situation. “The decision is ultimately a personal one, and what might be ideal for one could be disastrous for another,” reports WGN.

4

The Lump Sum Comes With More Taxes

The biggest difference between the two options is: The lump sum comes with more taxes. “You’d be taxed up to 37% federally, and then even more so depending on your state tax,” Steven Evensen, CFP, a financial advisor with Gerber Kawasaki Wealth and Investment Management, told Nexstar. “So I would speak to an accountant about that to make sure you aren’t kind of overspending in your head before you actually receive the money and receive your tax bill at the end of the day.” If you score a big jackpot in Powerball or MegaMillions, you’d probably want to live in these nine states, which don’t withhold state taxes on lottery winnings—read on.

California is one of the best states to win the lottery as it does not withhold state taxes on lottery winnings. However, winners should be aware that they will still be subject to the federal tax rate of 24% for amounts over $5,000.

Another state without state taxes on lottery winnings, Delaware offers a friendly environment for lottery winners. As in all states, federal taxes of 24% are still applicable for winnings above $5,000.

With no state income tax, Florida is an attractive state for lottery winners to reside in. This means lottery winners can keep more of their winnings without any state-level taxation.

Lottery winners in New Hampshire can celebrate as the state doesn’t tax lottery winnings. However, like in other states, federal taxes still apply.

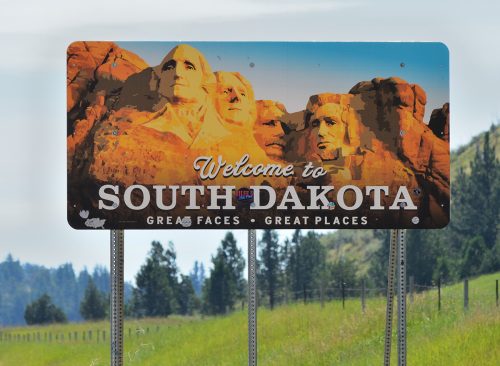

South Dakota is one of the nine states that don’t withhold state taxes on lottery prizes, making it a desirable location for those lucky enough to win big.

Tennessee also offers a favorable environment for lottery winners with no state taxes on lottery winnings. Nevertheless, winners will still need to consider federal taxes.

Texas is another state without state income tax, making it an appealing option for lottery winners to settle. However, the federal tax of 24% still applies to significant winnings.

Residents of Washington can rejoice as the state doesn’t impose state taxes on lottery prizes, offering winners a better chance to keep their full winnings.

Wyoming, like the other states on this list, does not tax lottery winnings at the state level. However, winners will still need to account for federal taxes on their prize money.